Are you typically as saver? Try out aggressive investing Are you typically a risk taker? Maybe try steady growth.

Sharpen your financial literacy and hone the concepts of investing and money making. As you play you’ll learn about yourself, your financial style and how it matches up against your opponents.

#Rich dad poor dad cashflow chart how to

Put your financial skills to the test and learn how to escape the rat race in the comfort of your own home. This game is the ultimate realization of Robert Kiyosaki's vision for an interactive tool to teach investing and wealth building. CASHFLOW was developed by renowned entrepreneur and motivational speaker Robert Kiyosaki, author of the bestselling personal finance book of all time, Rich Dad Poor Dad.

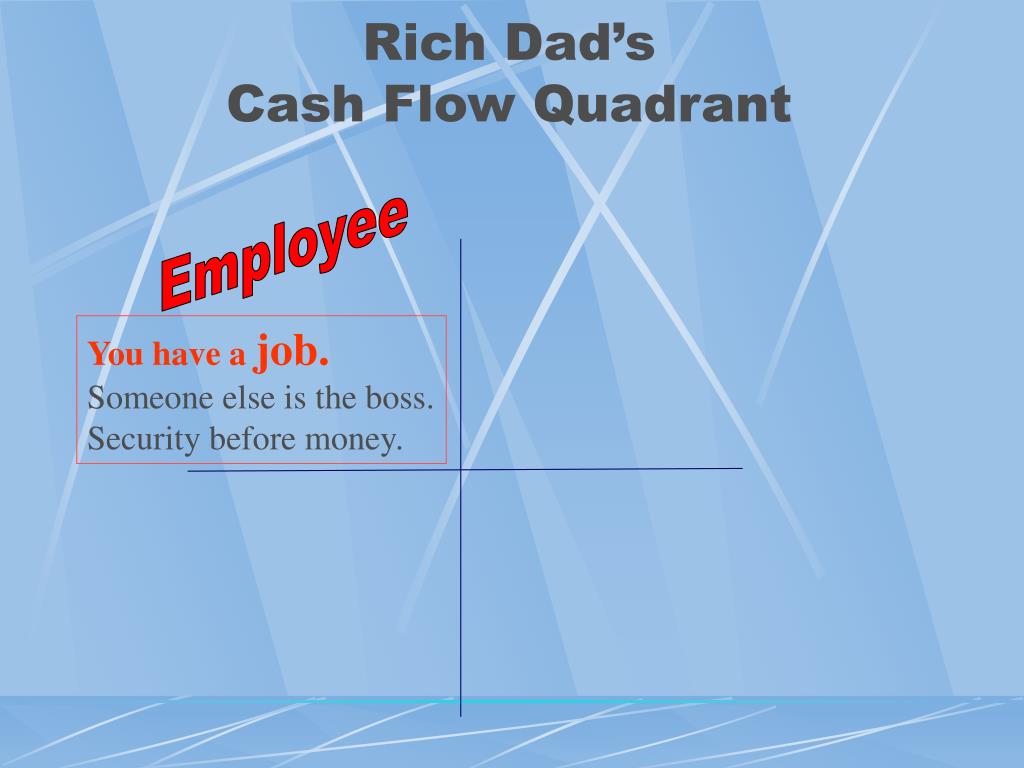

Click to return to the Size Chart filter options menu. When you work for an employer, you get paid only a fraction of the value that you generate for the employer (otherwise, if the business would. How Can The Rich Dad, Poor Dad Cash Flow Chart Help You Rich Dad, Poor Dad‘s cash flow chart offers a unique idea. You can look to the Rich Dad, Poor Dad cash flow chart to understand how money generates money. A house can be an asset or a liability depending on cash flow. Geschäft Rich Dad Poor Dad Cashflow Quadrant rich-dad-poor-dad poster und kunst entworfen von zap sowie andere rich-dad-poor-dad waren an TeePublic. The Rich Dad, Poor Dad, cash flow chart addresses an important basic principle of finance: having consistent cash flow helps make you rich. If you rent your house to others, or a room in your house, and it brings in more money than it costs you in expenses, THEN it’s an asset. Even if your mortgage is paid off, there is insurance and taxes and other expenses TAKING MONEY OUT OF YOUR POCKET. Your house is probably NOT an asset because it takes money out of your pocket. As you can see from a screenshot of Rich Dad, Poor Dad, you’re not ever actually saving anything. What makes something as asset is that it puts money into your pocket.Ī liability takes money out of your pocket. Many people are struggling financially today because they think some of their liabilities are assets. If you want to be rich, you have to know the difference between assets and liabilities. In 1997, when I released Rich Dad Poor Dad, I caused a bit of a commotion when I stated that your house is NOT an asset. In this second letter I will share another “Rich Dad Difference”, how we view Assets and Liabilities. In my first letter to you, I explained the CASHFLOW Quadrant.

I’m Robert Kiyosaki, author of the all time, best selling, personal finance book of all time, Rich Dad Poor Dad. Congratulations as you continue your journey to increase your financial IQ.

0 kommentar(er)

0 kommentar(er)